The Client

The client is a premier provider of cloud-based and SaaS platforms tailored for Property and Casualty insurers and MGAs globally. Their expertise spans policy management, billing, claims, and analytics, addressing a comprehensive range of 80+ lines of business.

The Challenges

- The client was operating on outdated legacy systems that hindered agility and efficiency.

- Integrating new digital technologies with their legacy system was complex and costly.

- The client needed to improve digital interfaces and streamline the customer journey to enhance user experience.

- The accuracy and quality of data are crucial for underwriting and risk assessment and require effective data management strategies.

- Adhering to regulatory requirements was expensive, affecting operational costs.

The Objective

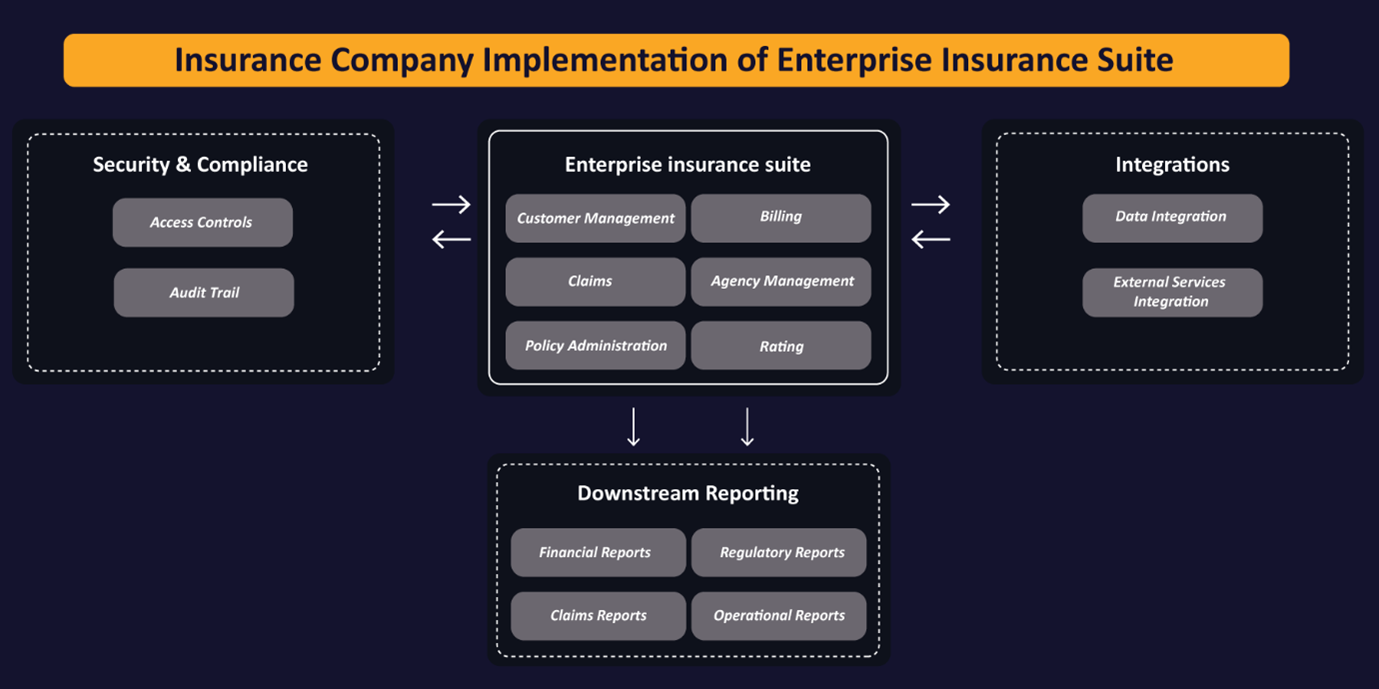

The project’s objective was to implement the Enterprise Insurance Suite for a prominent North American insurer across billing, policy, and claims procedures for different lines of business (Commercial auto, General liabilities, Commercial Property, Commercial inland marine, Crime, and Fidelity, Commercial package) and incorporating external service integrations to enhance operational efficiency and streamline insurance operations.

The Solution

- JK Tech team undertook the implementation of the Enterprise Insurance Suite

- Our responsibilities covered the entire implementation process, including requirement gathering, solutions development, and deployment across multiple lines of business.

- The implementation involved delivering effective solutions in key areas such as Policy, Claims, Billing, Rating, and other critical streams.

- Our team successfully integrated approximately 32 external services, customizing the system to meet the diverse needs of the client’s business.

- The new software system implementation was designed to empower the client, enabling them to operate their business more efficiently through highly automated processes.

Business Process Diagram:

The Benefits

- Our data-driven system empowers the client to swiftly adapt to evolving business needs with features such as Modular Architecture, Flexible Data Models, Self-Service Analytics, Real-time Processing, and seamless API Integration.

- The recently deployed system can seamlessly integrate with a variety of intricate technologies and external services via APIs.

- The improved user interface and user experience allow business users to engage with the system seamlessly.

- A robust data management strategy, including explicit governance policies, role delineation, and data handling guidelines, ensures resilience, scalability, platform accessibility, and fortified security in our data infrastructure.

- The incorporation of ISO ERC has revolutionized the update process for ISO loss costs, rules, and coverage details, eliminating manual efforts. This integration empowers customers to significantly reduce time and effort for analyzing, interpreting, and implementing changes.