The Client

The Client is one of the UK’s largest debt buyers and debt collection agencies.

The Challenges

- The client faced challenges in utilizing data effectively due to disparate sources, inconsistent formats, and handling large-size files.

- Siloed databases across various departments hindered data accessibility and integration.

- The absence of a centralized data strategy limited comprehensive insight derivation.

- Delay in reporting and inefficiencies in risk management.

- Suboptimal customer service due to fragmented data handling.

The Objective

- Data Integration: The goal was to consolidate data from disparate sources into a unified, centralized repository, facilitating easier access, analysis, and loading into different platforms.

- Data Quality Enhancement: We aimed to standardize and cleanse the data to ensure accuracy, consistency, and reliability.

- Advanced Analytics: The objective was to implement advanced analytics and machine learning models to enable the derivation of actionable insights.

- Compliance & Security: Ensuring compliance with regulatory standards and enhancing data security measures were prioritized to protect sensitive information such as demographic data

The Solution

- Data Integration and Centralization: Employed a fully automated robust data integration platform to aggregate and unify data from various sources such as transaction records, customer interactions, bureau data, and internal systems into a centralized cloud-based data lake.

- Data Quality Improvement: Conducted comprehensive data cleansing, normalization, and enrichment processes to enhance the accuracy and consistency of the data. This involved eliminating duplicates, resolving inconsistencies, applying validation rules, and using proper formats.

- Compliance and Security Measures: Adhered to GDPR and other regulatory standards while implementing stringent data security protocols. This included encryption, access controls, and regular audits to ensure data integrity, confidentiality, and file permissions.

- Advanced Analytics and Machine Learning: Implemented advanced analytics and machine learning algorithms to perform predictive modeling for risk assessment, customer segmentation, and personalized product recommendations. This empowered clients to make data-driven decisions for targeted marketing campaigns and improved risk management, implementing decision-making models for business growth.

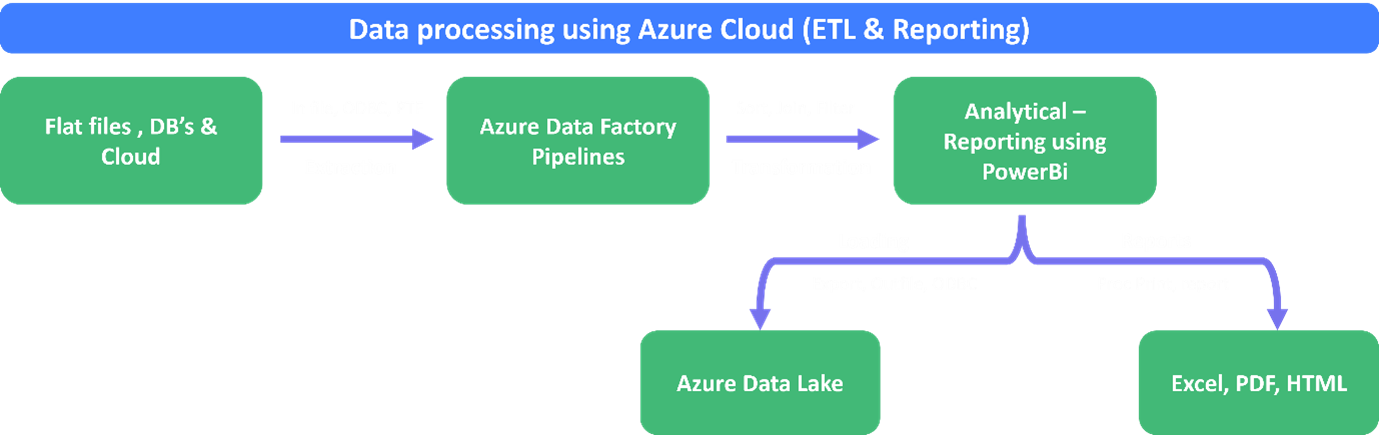

Business Process Diagram:

The Benefits

- Improved Decision-Making: Centralized and clean data enabled faster and more accurate decision-making processes across departments, leading to better risk management and personalized customer experiences.

- Compliance Adherence: Successfully met regulatory requirements, ensuring data privacy and security, fostering customer trust.

- Enhanced Operational Efficiency: Streamlined data processes reduced redundancies, improved reporting accuracy, and optimized resource allocation.

- Customer Satisfaction- Enhanced customer satisfaction through tailored deals and services, driven by accurate and comprehensive data insights.

- Accuracy and Fast Run: Model results ensure accurate and fast execution time of automated codes or jobs.